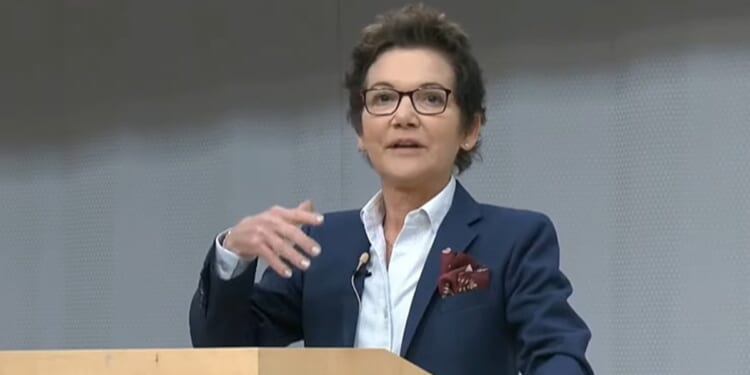

San Francisco Federal Reserve Bank President Mary Daly warned on Thursday that the “softening” U.S. job market could become “more worrisome” if the central bank is unable to “risk manage it.”

Daly’s comments come after the Fed announced on Sept. 17 that it was making its first interest rate cut of the year, following mounting pressure from President Donald Trump. Daly also said during a Thursday event at the Silicon Valley Directors Exchange that the Fed’s decision to cut rates in September was partly due to easing inflation and a slower labor market, Reuters reported.

“That interest rate cut we took — and we projected we might take more — those were cuts designed to risk manage as we move both our inflation goal and our employment goal to a more perfect balance,” Daly said, according to Reuters.

“The economy is slowing a little bit,” Daly added. “Consumers are running out of all the excess savings they might have had and they’ve been dealing with a higher price level. And then we have restrictive monetary policy.”

Federal Reserve Chair Jerome Powell notably said Sept. 23 that the Fed is currently grappling with a “challenging situation” due to inflation risks and recent lackluster employment data.

When asked about how artificial intelligence (AI) may affect the U.S. economy, Daly suggested that AI has the potential to be extremely impactful, but also noted that major economic shifts driven by innovation generally take decades, according to Reuters. The San Francisco Fed’s district includes Silicon Valley, seen as a major hub for AI innovation.

“We’re now in a forcing function where we might see the gains come faster, not just because of the AI itself and what the technology can do, but also because of where we are in the economy and how firms might be able to use it,” Daly said.

Widespread adoption of AI could potentially displace 6% to 7% of the U.S. workforce, according to a Goldman Sachs report released on Aug. 15. Goldman Sachs’ economists also predicted that an estimated 2.5% of employment in the U.S. could be at risk due to AI-related job losses, the report states.

Additionally, Federal Reserve Bank of New York President John Williams told The New York Times (NYT) in a Wednesday interview that he favored having more rate cuts this year.

“The risks of a further slowdown in the labor market is something I’m very focused on,” Williams told the NYT.

Williams added that he would support “lower rates this year, but we’ll have to see exactly what that means.”

All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].

DONATE TO BIZPAC REVIEW

Please help us! If you are fed up with letting radical big tech execs, phony fact-checkers, tyrannical liberals and a lying mainstream media have unprecedented power over your news please consider making a donation to BPR to help us fight them. Now is the time. Truth has never been more critical!

Success! Thank you for donating. Please share BPR content to help combat the lies.

We have no tolerance for comments containing violence, racism, profanity, vulgarity, doxing, or discourteous behavior. Thank you for partnering with us to maintain fruitful conversation.