Binance’s BNB token pushed to a new all-time high of $1,370 on October 13, defying a market-wide collapse that liquidated $19 billion from traders.

This stark outperformance wasn’t just luck. The real question is what allowed BNB to rally when other major assets were in a downturn. Its strength comes from three core areas: a wave of institutional demand fueling its momentum, massive growth in the BNB Chain DeFi ecosystem creating real utility, and a series of crucial network upgrades that made it all possible.

The BNB Rally

BNB’s recent performance has been nothing short of remarkable. In the week leading up to its new peak, the token grew by nearly 30%, a rally that culminated while the rest of the market was still processing one of the largest liquidation events in its history. While other assets saw double-digit losses, BNB demonstrated clear resilience.

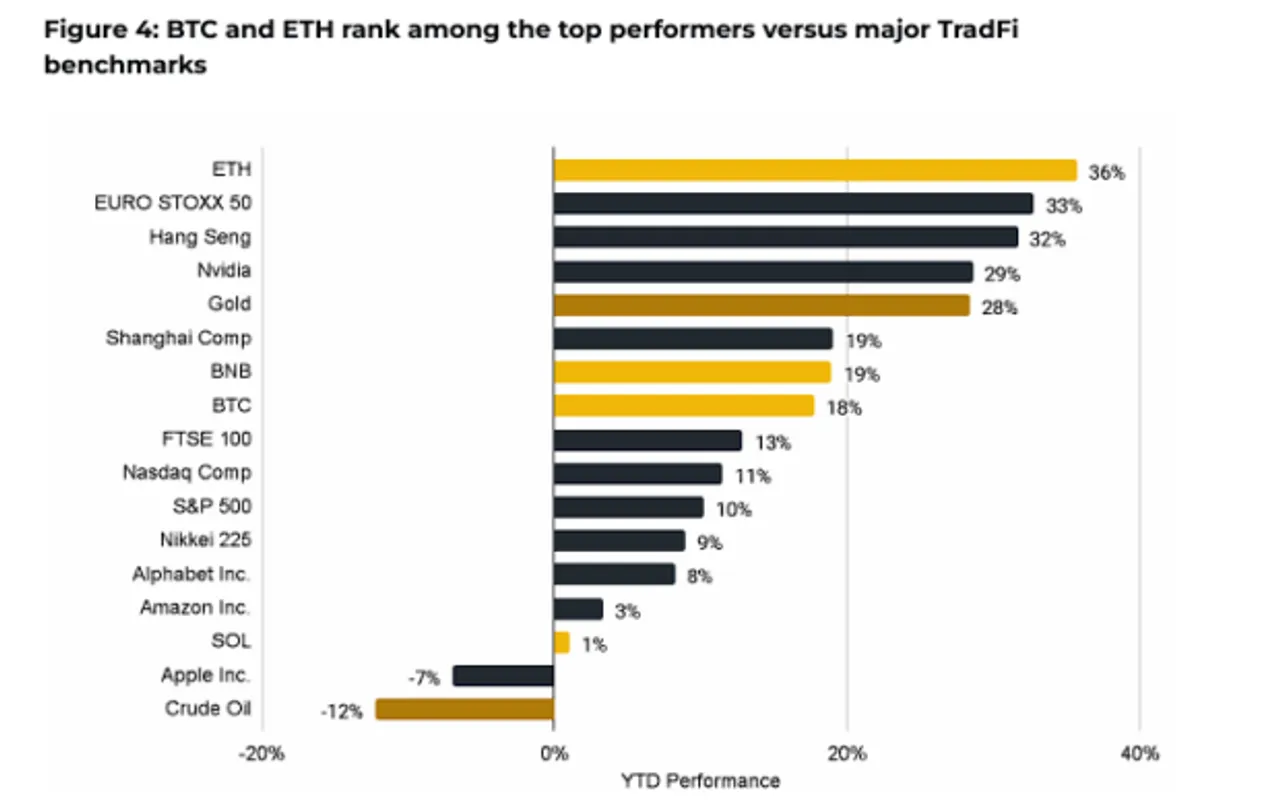

This market-defying strength is further highlighted when compared against other major assets. Year-to-date, BNB has posted an impressive 19% gain, keeping pace with Bitcoin’s 18% and outperforming many traditional benchmarks, though trailing Ethereum’s 36% return. Its performance places it among the top-tier assets in both the digital and traditional finance markets.

The Key Drivers Behind BNB’s Surge

This wasn’t just a speculative blip. The rally stood on solid ground, built on real fundamentals. You had growing confidence from institutions, a measurable expansion in on-chain activity, and critical tech upgrades that all contributed to a more powerful network.

Institutional Demand for BNB is Growing

A key pillar of BNB’s recent strength is the increasing flow of institutional capital, reflecting a calculated strategy by large entities to gain exposure. As Binance CEO Richard Teng commented in a recent interview with Fortune Magazine, “Wall Street’s growing embrace of crypto now extends far beyond the spot exchange-traded funds (ETFs) that dominated headlines in 2024.” Teng continued, “The creation of composite products and new models based on traditional instruments is accelerating, with BTC—and soon, other digital assets—becoming a cornerstone of modern financial infrastructure in many direct and indirect ways.”

Government-level confidence was signaled when Kazakhstan’s state-backed Alem Crypto Fund made its debut purchase with BNB, a significant endorsement of the asset’s long-term value from a sovereign entity. This move was followed by major financial sector interest, with investment bank China Renaissance announcing plans to raise $600 million for a publicly traded crypto treasury focused exclusively on BNB, with participation from YZi Labs.

Publicly traded companies are also adding BNB to their balance sheets. CEA Industries recently increased its holdings to 480,000 BNB. In another major move, Chinese blockchain firm Nano Labs is funding a significant BNB acquisition through a $500 million convertible notes deal. This pattern of adoption from governments, banks, and corporations shows that institutions increasingly view BNB as a strategic reserve asset, not just a speculative instrument.

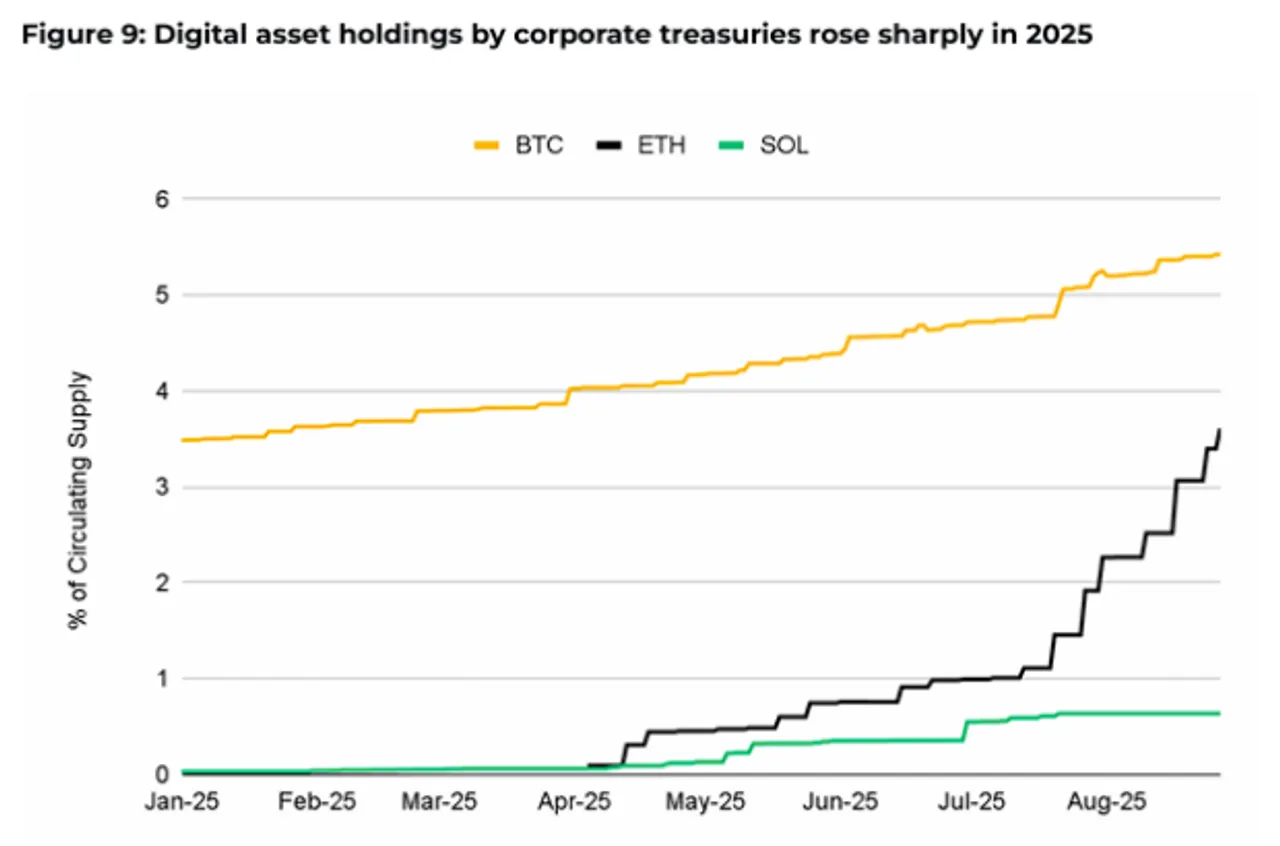

BNB accumulation by institutional investors aligns with the broader rise in corporate crypto treasuries. By August 27, corporate players had accumulated 1.07 million BTC and 4.36 million ETH, expanding their direct exposure to digital assets.

Growth in TVL and Network Activity

This institutional interest is matched by vigorous on-chain fundamentals. Over the last 30 days, the total value locked (TVL) in BNB Chain’s DeFi ecosystem jumped 18.85% to hit $9.08 billion by October 13. That growth boosted its market share among all blockchains from 4.79% to 6.91%. The numbers show capital isn’t just sitting there—it’s actively flowing in and being put to work.

Fueling this growth is real user activity. The network recently clocked a record 34.7 million daily transactions and maintains 58 million monthly active addresses. This boom in usage, especially on decentralized exchanges, is generating over $5.5 million in daily fees for BNB Chain—outpacing major rivals. Simply put, high TVL combined with massive transaction volume shows a healthy, useful ecosystem where demand is growing naturally.

Multiple Recent Network Upgrades

Technical upgrades have been a direct catalyst for the network’s expanding activity. The Lorentz hardfork in April 2025 improved validator networking and reduced block times, making the chain faster for time-sensitive applications. This was followed by the Maxwell upgrade in June, which further boosted network performance and block speed.

Technical upgrades have directly improved user experience, especially the official adoption of an ultra-low 0.05 Gwei gas fee. First, the network made transactions much cheaper, opening the door for more users. Then, one enhancement after another produced a more scalable and efficient system. This proved to be a critical factor in the latest surge of on-chain activity.

The Road Ahead for BNB

BNB’s recent all-time high was not a speculative anomaly but the result of a powerful convergence of fundamental strengths. What we’re seeing is a powerful mix of institutional buy-in, booming on-chain activity, and smart network upgrades all reinforcing BNB’s standing. This synergy created a durable base for the asset, which not only explains its market outperformance but positions it as a key player for the future of digital finance.

Members of the editorial and news staff of the Daily Caller were not involved in the creation of this content.

![Florida Officer Shot Twice in the Face During Service Call; Suspect Killed [WATCH]](https://www.right2024.com/wp-content/uploads/2025/12/Inmate-Escapes-Atlanta-Hospital-After-Suicide-Attempt-Steals-SUV-Handgun-350x250.jpg)