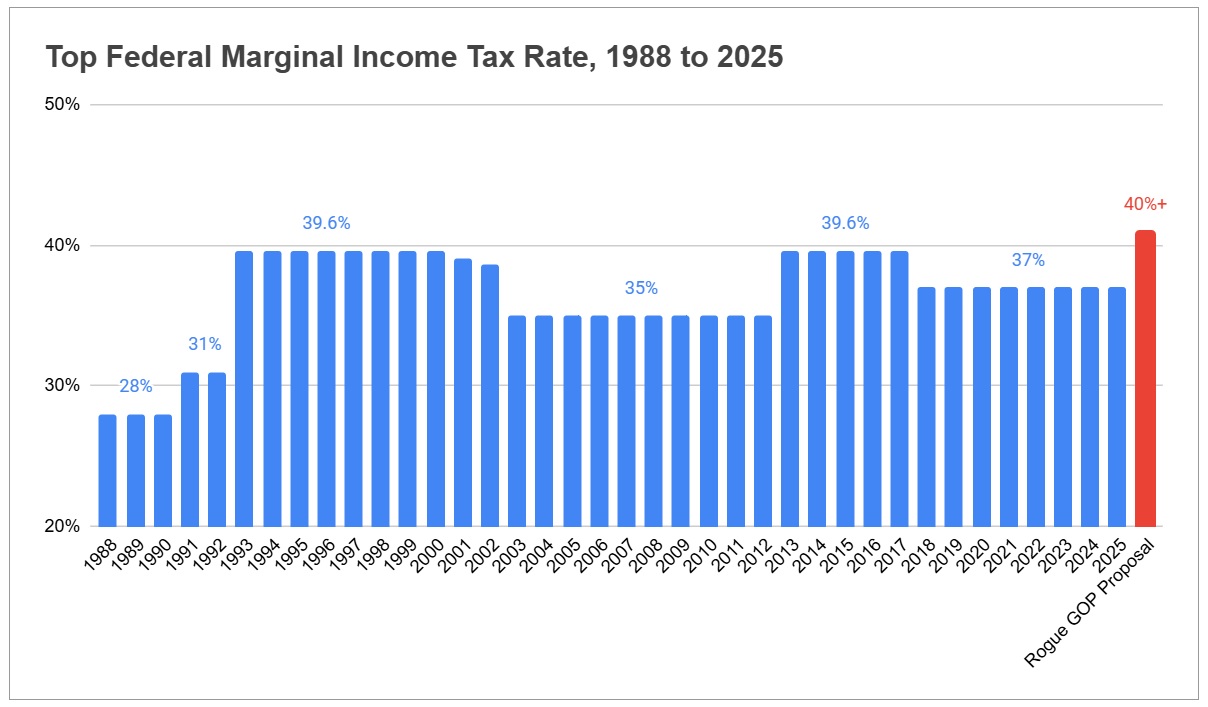

Rumors are swirling that Republicans are weighing a tax hike on $1 million-plus earners. This would create a brand new top rate of 40 percent or even higher. Such a GOP-sponsored tax increase would be an excellent tool — provided that Republicans wish to splinter their ranks, sink President Donald J. Trump’s Big, Beautiful Bill, slow the economy, and sandbag themselves in the 2026 midterm elections.

Aside from that, this is a brilliant idea.

“Terrible idea,” says Larry Kudlow, a veteran free-market advocate and host of Fox Business Network’s Kudlow program. Trump 45’s chief economic advisor also told me: “Trump should reward, not punish, success. Small businesses would be hurt badly by such a tax hike. The Laffer Curve shows that revenues will decline, not rise, due to tax avoidance. The top 1 percent already pays 45 percent of income taxes.”

Steve Moore, co-founder and chairman of Unleash Prosperity, warns, “This would be a total GOP betrayal.” The co-architect of 2017’s Trump/Republican Tax Cuts and Jobs Act added: “Almost all of the GOP members of Congress signed a pledge never to raise tax rates. Now, some of them sound like Bernie Sanders: ‘Sock it to the rich!’”

Chart: Unleash Prosperity. Data: Tax Policy Center

Unleash Prosperity’s recent chart shows that if Republicans hiked the top rate to 40 percent-plus, they would take a bigger bite out of taxpayers’ hides than Democrats Bill Clinton, Obama, and Joe Biden ever did. What a shameful distinction for Republicans to hold or even contemplate.

Parroting The Squad’s “eat the rich” talking points will buy Republicans no love on the Left. And on the Right, the ensuing rebellion among the overwhelming majority of Republicans (who understand that God created the GOP to cut taxes) would shatter the fragile unity required to navigate the Big, Beautiful Bill through each congressional chamber’s three-seat Republican majority. (RELATED: Keeping the Tax Cuts and Rebooting the Tax Code)

President Trump, who justifiably prides himself on making promises and keeping them, pledged this to taxpayers while campaigning last year: “I’ll give you a Trump middle class, upper class, lower class, business class, big tax cut.” There is nothing there about tax hikes on millionaires — or anyone else.

It would be bad enough if Democrats controlled the White House and Senate, and the Republican House reluctantly agreed to raise the top tax rate as a firewall against an even broader tax onslaught.

But Republicans are not at the mercy of Democrats. At last check, the GOP governs the Oval Office, the Senate floor, and the House speaker’s gavel. So, with command of these three levers of power, why the hell is any Republican letting the phrase “tax increase” cross his mind — even fleetingly?

Imagine if, God forbid, Kamala Harris won the White House, Chuck Schumer (D–New York) ruled the Senate, and a Speaker Hakeem Jeffries (D–New York) led the House. Under those conditions, would the wind carry whispers that Democrats were pondering a bill to limit abortions to women over age 21?

This would not happen. Full stop.

And yet, under equal-but-opposite circumstances, tax fighters have had to devote precious time and finite energy to explain the case against tax hikes, for the 10,000th time — but now, to convince fellow Republicans that this approach is idiotic.

- “President Trump campaigned on his commitment to cut every American’s tax rates and to extend those lower rates into the future,” Americans for Tax Reform (ATR) President and Founder Grover Norquist told me. “Kamala Harris promised to raise the top rate back up to Obama levels. It is disgusting that some White House staffers think they are more important than President Trump. They are not. Trump is right to fight to extend his tax cuts for all Americans.”

- “I’ve been monitoring talk radio, and not one conservative likes this idea,” said John Kartch, ATR’s communications director. “No Republican senator or congressman ran for office promising a tax-rate hike.” Kartch continued: “The tax-rate hike to 40 percent is an idea proposed by Kamala Harris last year. President Trump defeated Kamala Harris in the election, and President Trump rightly criticized her for the 40 percent tax rate idea. There is no reason to adopt Kamala’s tax policy.”

- “Putting a hike in the top income tax rate into what everybody thought would be the Trump tax CUT bill is absolute madness,” American Commitment President Phil Kerpen argued via X. “Not only would it destroy the Republican brand, but it would risk collapsing the bill and letting taxes go up on everyone. And for what? It would raise little or no revenue. It’s a trap.”

- Economic malpractice aside, turning the tax-cutting GOP into the tax-hiking Republican Party would be political hemlock. As former House Speaker Newt Gingrich reflected in the Daily Caller on, appropriately enough, April 15: “In 1988, then-Vice President George H.W. Bush pledged ‘Read my lips, no new taxes’ at the Republican National Convention (which earned huge applause). Yet, in 1990, President Bush allowed his senior staff and the Democrats to talk him into breaking his word. Bush’s tax increase was a catastrophic decision. It weakened the economy, split the Republican Party, and directly led to Bush’s defeat in 1992.”

Seven years after Daddy Bush died, conservatives still refuse to forgive him for this politico-economic sin — nor should they.

- National Review perfectly encapsulated conservative revulsion at a potential GOP tax increase: “If this is a trial balloon, it doesn’t even deserve to achieve enough altitude to get properly shot down.”

This repugnant tax-hike chatter might be fueled, in part, to find “pay fors,” so that the Congressional Budget Office’s static score of a final tax bill does not price it too high for passage. The answer here is not for the GOP to declare a War on Wealth. (RELATED: Budget Hawks v. Tax Cutters: The Republican Dilemma)

Republicans should stop being so goddamn nice: If the head of the Congressional Budget Office insists on performing static analysis on tax bills — which ignores tax reduction’s supply-side, growth-fueling, and revenue-producing effects — sack him and hire a supply-side economist, already, to helm the CBO and deploy dynamic scoring.

Unleash Prosperity co-founders Steve Forbes, Arthur Laffer, and Stephen Moore summarized the salutary impact of tax-rate reduction that dynamic scoring captures, as the trio wrote in Wednesday’s New York Post:

History has shown time and again that reducing marginal tax rates — particularly on individuals, entrepreneurs and small businesses — unleashes economic growth, expands the tax base, and ultimately generates more government revenue, not less.

Raising tax rates, on the other hand, nearly always has the same three consequences: less revenue than expected, slower economic growth, and reduced income taxes paid by the rich — as higher-income filers hire accountants to take advantage of loopholes and avoid those higher rates.

If Republicans cannot — at long last — place a dynamic-scoring expert atop CBO, then who really commands Congress? Does anyone doubt for three seconds that Democrats would sack that same supply-sider if they regained the House and Senate in November 2026? No. This is exactly what they would do — swiftly and without flinching.

House Speaker Mike Johnson (R–Louisiana) and Senate Majority Leader John Thune (R–South Dakota) should assign a dynamic scorer to direct the CBO right now, before the Big, Beautiful Bill arrives for valuation. Who cares how the Washington Post or Old Gray Lady would react? They despise Republicans. So, GOP leaders should stop worrying about them and get on with it.

As for boosting the top rate even one basis point above its current 37 percent, free-marketeers must heap non-stop, red-hot scorn atop this rotten idea, from withering heights, until Trump, Johnson, and Thune very publicly drive stakes through its heart, string garlic buds around its neck, and wave crosses in its face until it spontaneously combusts.

READ MORE from Deroy Murdock:

Is Georgetown on the Verge of a Financial Breakdown?

Randy Fine Is Right for Florida-6 US House Seat

This Aspect of the Atlantic’s “Scoop” Is All Wet

Deroy Murdock is a Manhattan-based Fox News Contributor.

![NYC Tourist Helicopter Falls into Hudson River, Siemens Executive and Family Among Those Killed [WATCH]](https://www.right2024.com/wp-content/uploads/2025/04/NYC-Tourist-Helicopter-Falls-into-Hudson-River-Siemens-Executive-and-350x250.jpg)

![Green Day’s Cringe Trump Diss Ends in Fire and Evacuation [WATCH]](https://www.right2024.com/wp-content/uploads/2025/04/Green-Days-Cringe-Trump-Diss-Ends-in-Fire-and-Evacuation-350x250.jpg)

![Red Sox Fan Makes the ‘Catch of the Day’ with Unconventional ‘Glove’ [WATCH]](https://www.right2024.com/wp-content/uploads/2025/04/Red-Sox-Fan-Makes-the-‘Catch-of-the-Day-with-350x250.jpg)