Andy Cook is Chief Executive of the Centre for Social Justice

Every now and then, a policy comes along which tugs at the heartstrings so strongly that even the most reasonable objections are quickly brushed aside.

Take free breakfast clubs. Concerned about value for money? About the implications for parental responsibility? About whether there are, in fact, more effective ways to transform the lives of the nation’s poorest kids?

Tough. Arguing against the provision of Cheerios for Britain’s tiny terrors is political no-man’s land. Indeed it was on this terrain that, as Labour began the roll out of the £400 million initiative earlier this week, shadow ministers took aim at . . . delivery challenges, duplication of existing programmes, and the reversal of a child benefit boost ministers have used to fund the policy.

Nonetheless, there is more to the latter point than meets the eye. Last Autumn the Chancellor announced she would scrap Conservative plans to increase the threshold of the – be warned, extremely wonky term inbound – High Income Child Benefit Charge (HICBC) from £50,000 to £60,000.

In a context where almost all schools already lay on breakfast clubs for disadvantaged children, it is difficult to see a compelling case for universalisation. Though efforts to tackle the absence crisis are essential, almost two in three headteachers think the initiative will make “no difference to attendance”. And leaving child benefit alone simply prolongs a squeeze on families that is not only unfair on dual earners but impedes growth by reducing work incentives.

Zooming out: while the debate over school breakfasts has been muted, the battle for the vote of Britain’s parents rages on ahead of next month’s important local elections. The old assumption held that having children tended to turn idealists into pragmatists, and pragmatists into conservatives. Yet 2024 saw younger families swing to Labour, a trend captured in the rise of the so-called Stevenage Woman.

The spectre of technology and social media looms large. As a dad of three girls, I know the sense of dread that comes from thinking about the online world they’re growing up in – a feeling shared by millions of parents across Britain. Recent polling by More in Common found that over half of parents support tougher restrictions on smartphone use in schools.

Kemi Badenoch has led the charge here, challenging the Prime Minister repeatedly on the case for an all-out ban in schools, and speaking movingly over the weekend about the tragic case of a cousin driven to suicide after falling down the “internet rabbit hole”. The momentum is clearly with her on this.

But – as the Conservative policy commissions get underway – the party would be wise to look again at the small print of child benefit changes set out last Spring and carried forward in their manifesto. Far from just being about rates and thresholds, if you look closely, it is here that the seeds of an altogether more fundamental reset of the relationship between the state and Brtiain’s parents were laid.

Let me explain. At present, save for the marriage allowance introduced by David Cameron, UK taxation is overwhelmingly based on individuals. This makes us something of an outlier. In France, Germany, and the US, the tax system is able to consider the household – recognising that starting a family takes time and money. It is a model with obvious benefits for parents. In France, for example, couples with children can significantly reduce their tax burden as the income of family members is combined when calculated, a structure that supports both working and stay-at-home parents.

And so when Chancellor Jeremy Hunt outlined plans to move towards judging child benefit on a household basis, this had the potential to slay the administrative dragon and build a fairer tax system for parents.

This was welcomed by the Centre for Social Justice (CSJ) at the time, after we called for the introduction of a Family Credit, allowing parents to pool their full tax allowance and consolidate the labyrinth of childcare subsidies into a single credit with greater spending flexibility. Polling by Public First for the CSJ found that parents preferred this approach versus extra funding for institutional childcare settings by two to one.

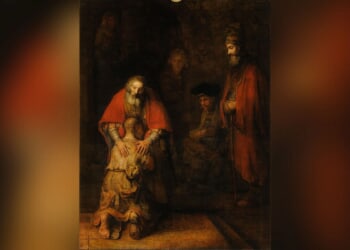

Above all, reimagining the way we support parents reflects something deeper: the need to reorient the Westminster bubble toward the actual hopes, fears, and priorities of families across Britain. As one small charity in Stockton told our commission into left-behind communities last year: “One of the things we get frustrated with when we’re working with Government and MPs is that they seem to forget how important family is to all of us.” It is telling, after all, that Reform has inserted the forgotten F-word into their mantra of “family, community, nation”.

Ensuring Britain’s poorest children are well-fed could not be more important. But far too often, the debate is shut down through simplistic appeals to “think of the children”, dodging the role and responsibilities that parents play. Policy for parents must go beyond the cereal bowl. Rethinking the way our tax system supports families is an excellent place to start.

![NYC Tourist Helicopter Falls into Hudson River, Siemens Executive and Family Among Those Killed [WATCH]](https://www.right2024.com/wp-content/uploads/2025/04/NYC-Tourist-Helicopter-Falls-into-Hudson-River-Siemens-Executive-and-350x250.jpg)

![Green Day’s Cringe Trump Diss Ends in Fire and Evacuation [WATCH]](https://www.right2024.com/wp-content/uploads/2025/04/Green-Days-Cringe-Trump-Diss-Ends-in-Fire-and-Evacuation-350x250.jpg)

![Red Sox Fan Makes the ‘Catch of the Day’ with Unconventional ‘Glove’ [WATCH]](https://www.right2024.com/wp-content/uploads/2025/04/Red-Sox-Fan-Makes-the-‘Catch-of-the-Day-with-350x250.jpg)