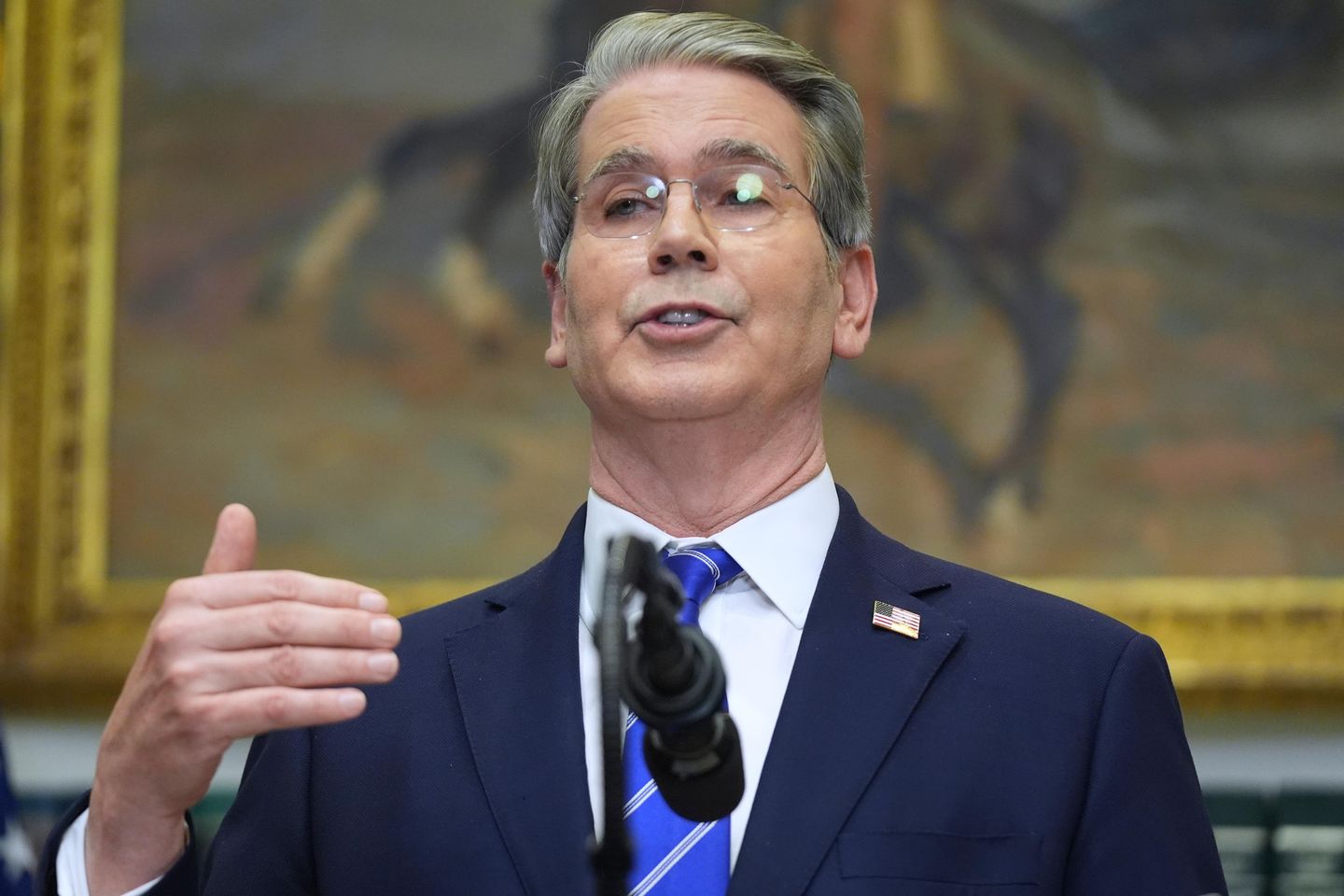

WASHINGTON — Treasury Secretary Scott Bessent said Wednesday he would push a new requirement that the Federal Reserve’s regional bank presidents live in their districts for at least three years before taking office, a move that could give the White House more power over the independent agency.

In comments at the New York Times’ DealBook Summit, Bessent criticized several presidents of the Fed’s regional banks, saying that they were not from the districts that they now represent, “a disconnect from the original framing” of the Fed.

Bessent said that three of the 12 regional presidents have ties to New York: Two previously worked at the New York Federal Reserve, while a third worked at a New York investment bank.

“So, do they represent their district?” he asked. “I am going to start advocating, going forward, not retroactively, that regional Fed presidents must have lived in their district for at least three years.”

Bessent added that he wasn’t sure if Congress would need to weigh in on such a change. Under current law, the Fed’s Washington, D.C.-based board can block the appointment of regional Fed presidents.

“I believe that you would just say, unless someone’s lived in the district for three years, we’re going to veto them,” Bessent said.

Bessent has stepped up his criticism of the Fed’s 12 regional bank presidents in recent weeks after several of them made clear in a series of speeches that they opposed cutting the Fed’s key rate at its next meeting in December. President Donald Trump has sharply criticized the Fed for not lowering its short-term interest rate more quickly. When the Fed reduces its rate it can over time lower borrowing costs for mortgages, auto loans, and credit cards.

The prospect of the administration “vetoing” regional bank presidents would represent another effort by the White House to exert more control over the Fed, an institution that has traditionally been independent from day-to-day politics.

The Federal Reserve seeks to keep prices in check and support hiring by setting a short-term interest rate that influences borrowing costs across the economy. It has a complicated structure that includes a seven-member board of governors based in Washington as well as 12 regional banks that cover specific districts across the United States.

The seven governors and the president of the New York Fed vote on every interest-rate decision, while four of the remaining 11 presidents vote on a rotating basis. But all the presidents participate in meetings of the Fed’s interest-rate setting committee.

The regional Fed presidents are appointed by boards made up of local and business community leaders.

Three of the seven members of the Fed’s board were appointed by Trump, and the president is seeking to fire Governor Lisa Cook, which would give him a fourth seat and a majority. Yet Cook has sued to keep her job, and the Supreme Court has ruled she can stay in her seat as the court battle plays out.

Trump is also weighing a pick to replace Chair Jerome Powell when he finishes his term in May. Trump said over the weekend that “I know who I am going to pick,” but at a Cabinet meeting Tuesday said he wouldn’t announce his choice until early next year. Kevin Hassett, a top economic adviser to Trump, is widely considered Trump’s most likely choice.

The three regional presidents cited by Bessent are all relatively recent appointees. Lorie Logan was named president of the Dallas Fed in August 2022, after holding a senior position at the New York Fed as the manager of the Fed’s multitrillion dollar portfolio of mostly government securities. Alberto Musalem became president of the St. Louis Fed in April 2024, and from 2014-2017 was an executive vice president at the New York Fed.

Beth Hammack was appointed president of the Cleveland Fed in August 2024, after an extended career at Goldman Sachs.

Musalem is the only one of the three that currently votes on policy and he supported the Fed’s rate cuts in September and October. But last month he suggested that with inflation elevated, the Fed likely wouldn’t be able to cut much more.

Logan has said she would have voted against October’s rate cut if she had a vote, while Hammack has said that the Fed’s key rate should remain high to combat inflation. Both Hammack and Logan will vote on rate decisions next year.

Bessent argued last month in an interview on CNBC that the reason for the regional Fed banks was to bring the perspective of their districts to the Fed’s interest rate decisions and “break the New York hold” on the setting of interest rates.