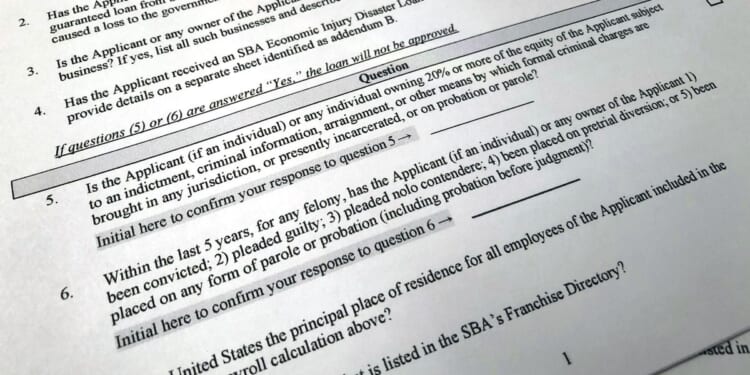

The Small Business Administration forgave $4.6 billion in pandemic loans to people on its naughty list, the agency’s inspector general said Wednesday while scolding the government for an overly relaxed approach to recouping taxpayer money.

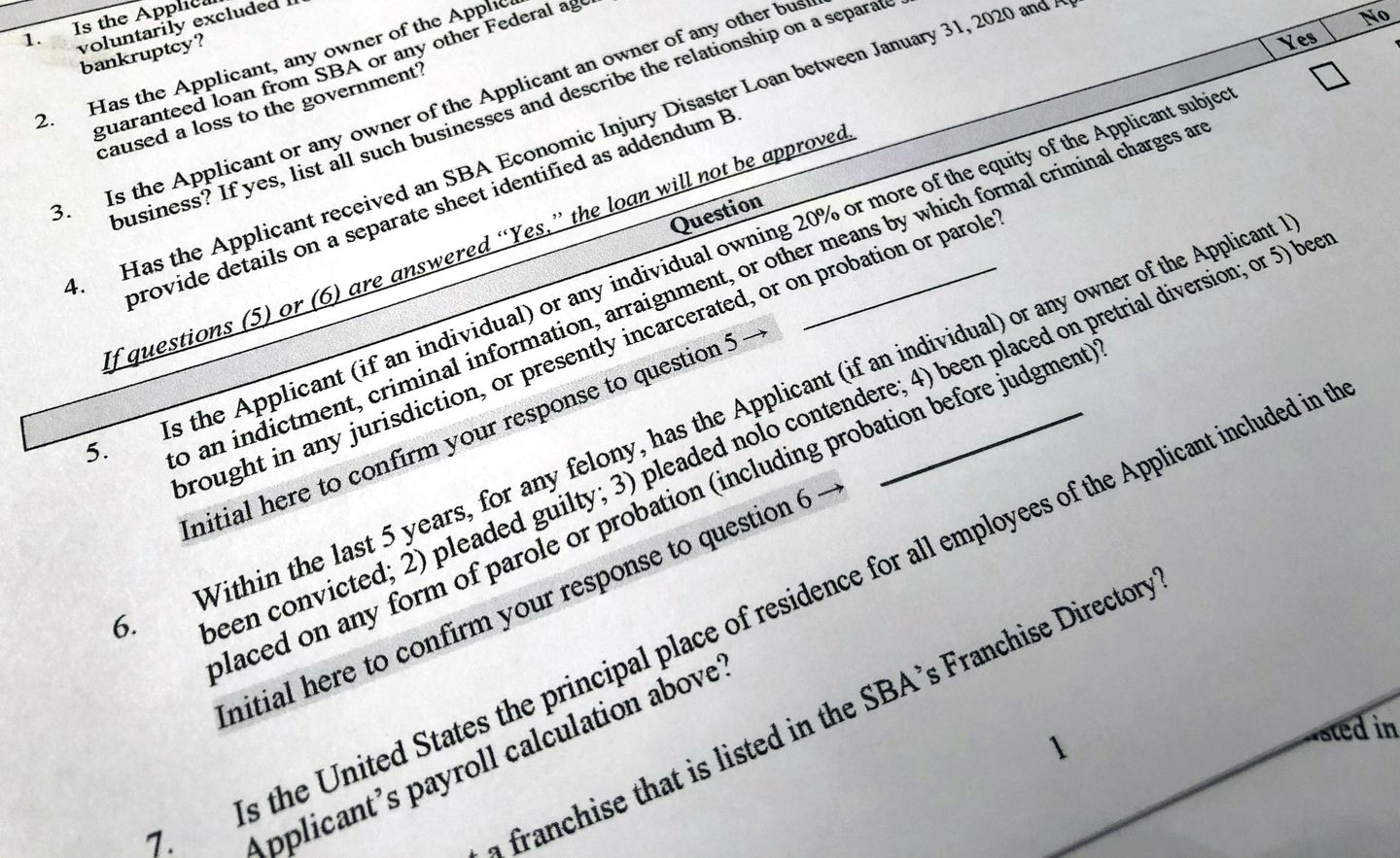

The loans were from the Paycheck Protection Program, one of the three major programs Congress created in 2020 to keep the economy afloat amid COVID-19 shutdowns.

Investigators said nearly 38,000 PPP loans forgiven have an open “hold code” attached, indicating that the applications were ineligible for either the initial payment or forgiveness.

Under SBA rules, a four-step process is required to make a final judgment and decide whether to recoup the money. The audit said the SBA hadn’t completed that process for 37,938 loans.

“It is imperative that SBA completes its review to promote program integrity and mitigate financial loss by seeking recovery of improper payments for ineligible loans,” said Sheldon Shoemaker, the deputy inspector general.

The audit said that the longer the reviews drag on, the less likely the government is to recover the money.

“The ability of an agency to collect on delinquent debts generally decreases as debts get older,” the report said.

The SBA ran PPP and the Economic Injury Disaster Loans. Both were designed to pump money into small businesses affected by pandemic shutdowns. Congress also siphoned cash into enhanced unemployment benefits for workers displaced by the shutdowns.

Experts said all three programs were plagued by fraud and hundreds of billions of dollars went to scammers in the U.S. and abroad.

Sen. Joni Ernst, Iowa Republican and chair of the Senate Small Business Committee, has complained about the stolen money and said the report “rubs salt in the wound.”

“Not only did fraudsters steal money designated for small businesses in need, but the Biden administration forgave billions in loans that potentially needed to be clawed back, due to ineligibility, misuse or suspected fraud,” she said. “I will not let con artists off the hook and will continue fighting to ensure that every COVID dollar stolen is recouped and the criminals responsible are held accountable.”

Two and a half years after the pandemic began, the PPP had paid out more than 11.3 million loans totaling nearly $800 billion.

It had forgiven 10.5 million, totaling $756 billion, as of Oct. 23, 2022.

The SBA grumbled about some details in its official reply to the report. It indicated that the full four-step process may not be required in every case.

Ultimately, the agency agreed with the inspector general’s recommendations to develop a formal policy for recovering loans with hold codes that are eventually deemed ineligible and to complete all the necessary reviews.

“These reviews will continue as resources allow, and SBA plans to work with the new administration to develop and implement a recovery plan for all ineligible loans,” said Jihoon Kim, director of SBA’s Office of Financial Program Operations.

The inspector general said the agency blamed a lack of “infrastructure” for its inability to complete all the reviews.

“The agency indicated it is working on competing priorities and could not state when the updates would be completed,” the report said.

Most of the loans at issue, 26,234, were for $25,000 or less. Under the SBA’s rules, the agency said those can be classified as “immaterial,” and officials usually won’t seek to claw back money at that level.

The inspector general said that was a mistake.

“These are missed opportunities to collect improper payments for loans deemed ineligible,” the inspector general said. “In addition, not attempting to recover the improper payments could set a precedent for future programs and incentivize ineligible borrowers to obtain loans valued at $25,000 or less.”

![NYC Tourist Helicopter Falls into Hudson River, Siemens Executive and Family Among Those Killed [WATCH]](https://www.right2024.com/wp-content/uploads/2025/04/NYC-Tourist-Helicopter-Falls-into-Hudson-River-Siemens-Executive-and-350x250.jpg)

![Green Day’s Cringe Trump Diss Ends in Fire and Evacuation [WATCH]](https://www.right2024.com/wp-content/uploads/2025/04/Green-Days-Cringe-Trump-Diss-Ends-in-Fire-and-Evacuation-350x250.jpg)

![Red Sox Fan Makes the ‘Catch of the Day’ with Unconventional ‘Glove’ [WATCH]](https://www.right2024.com/wp-content/uploads/2025/04/Red-Sox-Fan-Makes-the-‘Catch-of-the-Day-with-350x250.jpg)

![Bikini Clad Spring Breakers Prove Our Education System is Failing Students [WATCH]](https://www.right2024.com/wp-content/uploads/2025/03/Bikini-Clad-Spring-Breakers-Prove-Our-Education-System-is-Failing-350x250.jpg)