America has a real shot at ending its dangerous reliance on the People’s Republic of China (PRC) for rare earth elements, but only if it is willing to take decisive action, industry experts say.

Rare earths are a group of 17 metallic elements integral to the production of vehicles, weapons systems, wind turbines, smartphones, medical devices and other advanced technologies. Despite their commercial and strategic significance, the U.S. imports 80% of the rare earths it consumes, primarily from China, which accounts for the vast majority of the world’s rare earth mining and 92% of refining capacity.

“This is not a problem that the U.S. can’t solve. It’s a problem that we haven’t bothered to solve,” Derek Scissors, senior economist at the American Enterprise Institute and chief economist of the China Beige Book, told the Daily Caller News Foundation.

The risks of relying on China for such critical supplies were laid bare in April when Beijing imposed new export controls on several rare earth elements in retaliation against President Donald Trump’s “Liberation Day” tariffs on Chinese goods, causing severe supply chain disruptions. (RELATED: Trump Admin Twists China’s Arm On Fentanyl)

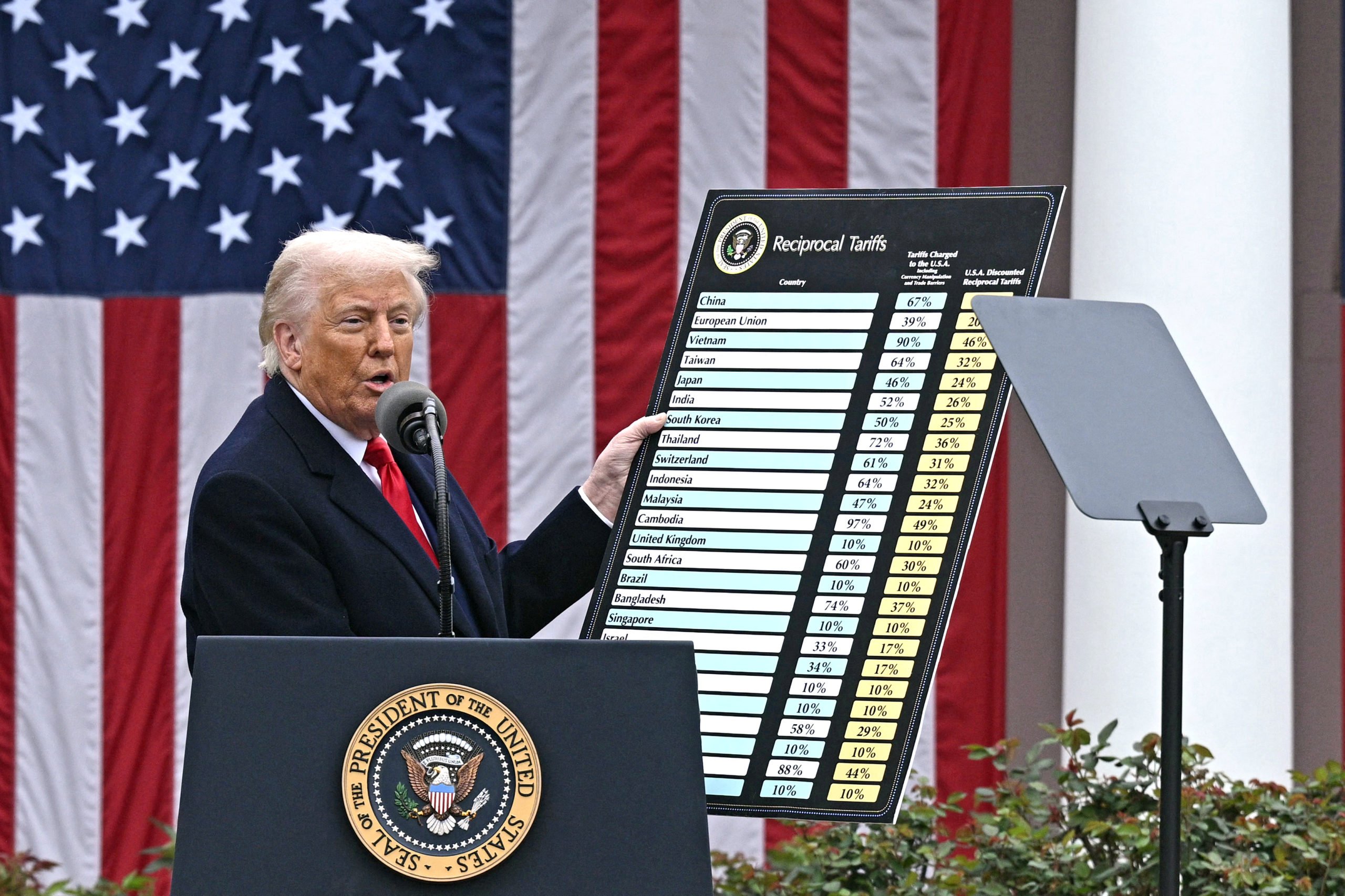

US President Donald Trump delivers remarks on reciprocal tariffs as US Secretary of Commerce Howard Lutnick holds a chart during an event in the Rose Garden entitled “Make America Wealthy Again” at the White House in Washington, DC, on April 2, 2025. (Photo by BRENDAN SMIALOWSKI/AFP via Getty Images)

“All the procurement folks told their bosses that ‘China would never shut off production of rare earths. This is a good bet, and it allows us to lower costs,’ but what happened is that they got shown in a clear and public way that it was wrong,” Nick Myers, CEO of Phoenix Tailings, one of the few rare earth processing companies in the U.S, told the DCNF.

Some companies have reported operating “hand-to-mouth,” with Ford being forced to temporarily halt production at a Chicago plant in May due to a shortage of rare earth elements. Even as Chinese authorities pledged to ease export controls following trade talks with the Trump administration in June, the PRC has reportedly continued stalling approvals for export licenses through bureaucratic processes.

If recent history is any indication, Beijing is willing to weaponize its control over rare earth minerals not only for economic advantages but also to exert territorial and military pressure. In 2010, for example, China halted rare earth shipments to Japan during a dispute over the Japan-held Senkaku Islands, raising serious concerns about how it might use that leverage in future disputes.

In 2023, the House Select Committee on the Chinese Communist Party (CCP) warned that China would likely restrict U.S. access to critical minerals in the event of conflict over Taiwan, and urged Congress to take swift action to reduce America’s dependence on the PRC.

“Should the United States lose access to processed critical minerals from foreign sources, the United States commercial and defense manufacturing base for derivative products could face significant shortages and an inability to meet demand,” reads an April executive order from Trump directing the secretary of commerce to investigate the possibility of new tariffs on critical minerals.

Still, progress in securing America’s rare earth supply chain has so far been sluggish at best. Myers and Scissors argue that focusing primarily on securing Chinese rare earth exports through trade negotiations fails to address deeper issues, such as China’s deliberate strategy to price out competitors and onerous environmental regulations that hinder rare earth projects.

“Whether or not China will hold trade restrictions in the long term doesn’t matter,” said Myers. “The fact is that they’re willing to shut it off, exposing companies to a massive risk profile.” (RELATED: China Has The Pentagon Over A Barrel, But Trump Can Stop It)

Bulldozers scoop soil containing various rare earth to be loaded on to a ship at a port in Lianyungang, east China’s Jiangsu province on September 5, 2010, for export to Japan. (Photo credit should read STR/AFP via Getty Images)

For decades, the Chinese government has flooded global markets with underpriced rare earths, subsidizing financial losses to drive emerging competitors out of business, according to the Center for Strategic and International Studies. In 2021, it consolidated three major producers into a single state-owned enterprise to tighten control over production and pricing.

“That’s historically how the Chinese controlled the market and performed economic warfare,” said Myers, explaining that China’s practices create price swings that discourage investors and make it hard for U.S. companies to raise capital. He called for pricing transparency for rare earth minerals, suggesting a system similar to the Manufacturer’s Suggested Retail Price used in the automotive industry, to help stabilize prices.

Scissors also recommends the U.S. respond to “Chinese predation” by invoking Section 232 of the Trade Expansion Act, which allows the federal government to erect barriers or quotas on imports that threaten national security.

“If this is such a big deal that we’re rushing across the world to negotiate new rare earth deals with China, then we should be taking drastic domestic actions,” said Scissors. “The punchline is, the cost increase involved in moving off of Chinese supplies is very small. Our goods will be close to price competitive with China’s; it’s just a matter of whether you want that little extra cost cut.”

Scissors also argued that Washington must be willing to reform domestic policies, including suspending parts of the National Environmental Policy Act, to make mining and processing critical minerals in the U.S. cheaper and faster. Despite America’s potential to be a major lithium producer, state and federal regulations have stalled the development of lithium mines and increased costs in mineral-rich states, according to the Institute for Energy Research.

Rare earth mining and refining are highly toxic processes, but China has historically overlooked environmental concerns, according to the Oxford Institute for Energy Studies. However, Myers believes the U.S. can become a world leader in processing rare earths, not by copying China, but by out-innovating them.

Myers’ company, Phoenix Tailings, has developed a new process for extracting rare earth metals from raw materials and mining waste without generating toxic byproducts or emissions, all while remaining independent of the Chinese economy.

The company currently operates a 40-ton-per-year processing facility in Massachusetts and will open a new facility in New Hampshire in August, starting with 200 tons, or approximately half of the defense industry’s rare earth needs, according to Myers. The company is raising capital for another 4,000-ton facility planned for next year, which can fulfill 40% of the U.S. commercial needs.

“I believe the U.S. can be a leader in this sector. The reason countries like China can be successful is that they don’t care about technological innovation, and they just discharge waste,” Myers said. “But what they’re doing is uneconomical. These are technical hurdles, and if you can develop technology in the right way, you can be a cost-effective leader.”

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.

![Florida Man With Violent History Arrested for Choking a Cop [WATCH]](https://www.right2024.com/wp-content/uploads/2025/06/Eleven-Stabbed-in-Attack-at-Salem-Homeless-Shelter-Across-From-350x250.jpg)