Jeffrey Epstein reportedly rose from a college dropout and math teacher to a multimillionaire financier, a trajectory that has fueled ongoing speculation about the source of his wealth.

Epstein, a native New Yorker, began his career teaching math at Manhattan’s Dalton School in the mid-1970s — despite never earning a college degree, CBS News reported, citing reports and court documents. Epstein was dismissed from his teaching position for poor performance, a school administrator told The New York Times (NYT).

His time at Dalton led him to tutor the son of Alan Greenberg, then CEO of Bear Stearns, which helped him secure a job at the firm, according to CBS News. Epstein quickly climbed the ranks, becoming a limited partner at the firm, Vanity Fair reported. (RELATED: The Insane Coincidences In The Jeffrey Epstein Story)

He claimed he left to launch his own company in 1981. He would go on to run J. Epstein & Co. — appearing to mark the beginning of his rise into the world of high finance and elite social circles.

He managed money for billionaires like Les Wexner, former CEO and founder of L Brands, and Leon Black, former Apollo Global Management Chairman, CBS News reported.

Representatives for Les Wexner and L Brands declined to provide basic information about the nature of Epstein’s work for Wexner, according to another NYT report.

“While Mr. Epstein served as Mr. Wexner’s personal money manager for a period that ended nearly 12 years ago, we do not believe he was ever employed by nor served as an authorized representative of the company,” said L Brands spokeswoman Tammy Roberts Myers in 2019.

Wexner gave Epstein sweeping authority over his finances, including the power to borrow funds, sign tax documents, recruit staff and make acquisitions, the outlet reported, citing interviews, court documents and financial records.

During their relationship, he reportedly acquired several high-value assets once owned by Wexner or his companies — including a New York mansion, a private jet and an Ohio estate — worth around $100 million.

Epstein also reportedly distanced Wexner from longtime friends and associates.

In a 2003 interview with Vicky Ward, former Vanity Fair reporter, Rosa Monckton, former CEO of Tiffany & Co., described Epstein as “very enigmatic” and likened him to “a classic iceberg.”

“You think you know him and then you peel off another ring of the onion skin and there’s something else extraordinary underneath … What you see is not what you get,” she said. (RELATED: Pam Bondi Claims ‘No Knowledge’ Of Epstein Being Intel Asset — But Evidence Is Overwhelming)

In March 2025, the Senate Committee on Finance released further details on a $62 million settlement between Black and the U.S. Virgin Islands Attorney General from 2023, which granted Black immunity from criminal charges related to financial ties to Epstein. Black transferred $170 million to Epstein over the course of five years, according to documents obtained by the committee.

A law firm hired by Apollo’s board released an independent review of Black’s relationship with Epstein and found no wrongdoing. He exited the role of Apollo’s chairman and CEO in 2021.

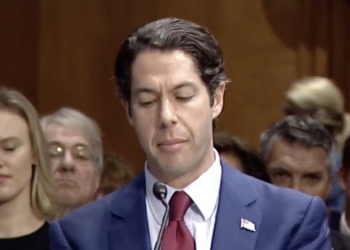

Benjamin Black, son of the former Apollo chairman, is awaiting confirmation to lead the U.S. International Development Finance Corporation, an agency that supports U.S. foreign policy through private investment.

Epstein has also been connected to the late Steven Hoffenberg, the former head of Towers Financial Corporation, who was later convicted of a massive over-$450 million Ponzi scheme, according to the 2003 Vanity Fair report. The Associated Press described him as Epstein’s “mentor.”

Reportedly introduced by mutual contacts, Epstein worked as a consultant for Hoffenberg, earning a substantial salary, according to Vanity Fair. Hoffenberg reportedly appreciated the social connections the former possessed.

Epstein had managed International Assets Group (I.A.G.), dealing in risky investments and recovering stolen funds, according to court documents. Hoffenberg supported Epstein’s rise in finance, even setting him up with offices on Madison Avenue, sources told the outlet.

Their relationship was close and they frequently traveled together, according to another source. Epstein allegedly confided in Hoffenberg about his past and financial dealings.

Just two days before Epstein’s death, the convicted sex offender signed a new will — an action revealed through probate documents obtained by NBC News. The probate petition and a list of Epstein’s assets were filed in the U.S. Virgin Islands, where he owned an island. Two witnesses said in affidavits that Epstein “signed it willingly” and was “of sound mind and under no constraint or undue influence.”

Epstein’s estate was valued at nearly $578 million — about $18.5 million more than he claimed during his failed 2019 bail bid — with the added amount listed as “aviation assets, automobiles and boats,” according to the outlet.

By placing his fortune into the 1953 Trust — named for his birth year — Epstein removed the terms from the public record, according to CBS News. “The terms of the trust remain private because they are not part of the will itself,” Cornell Law School Professor Gregory S. Alexander said, adding that such trusts are frequently created to ensure privacy.

Epstein’s final will left nothing to his brother Mark — who would have inherited the estate without a will. (RELATED: Unanswered Questions Continue To Fuel Epstein Speculation)

A woman who accused Epstein of abuse filed a lawsuit against Deutsche Bank alleging that they profited off of human trafficking by retaining Epstein by doing business with him. The bank agreed in May 2023 to a $75 million settlement.

Another alleged victim of Epstein sued JPMorgan Chase, accusing the bank of enabling Epstein’s child sex trafficking by continuing to do business with him after his previous guilty plea. The bank reached a tentative settlement in June 2023.

![Steak ’n Shake Mocks Cracker Barrel Over Identity-Erasing Rebrand [WATCH]](https://www.right2024.com/wp-content/uploads/2025/08/Steak-n-Shake-Mocks-Cracker-Barrel-Over-Identity-Erasing-Rebrand-WATCH-350x250.jpg)

![Soros Network, Others Behind LA Riots [WATCH]](https://www.right2024.com/wp-content/uploads/2025/06/Soros-Network-Others-Behind-LA-Riots-WATCH-350x250.jpg)

![Human Trafficking Expert Details Horrific Biden Admin Endangerment of Migrant Kids [WATCH]](https://www.right2024.com/wp-content/uploads/2025/07/Human-Trafficking-Expert-Details-Horrific-Biden-Admin-Endangerment-of-Migrant-350x250.jpg)