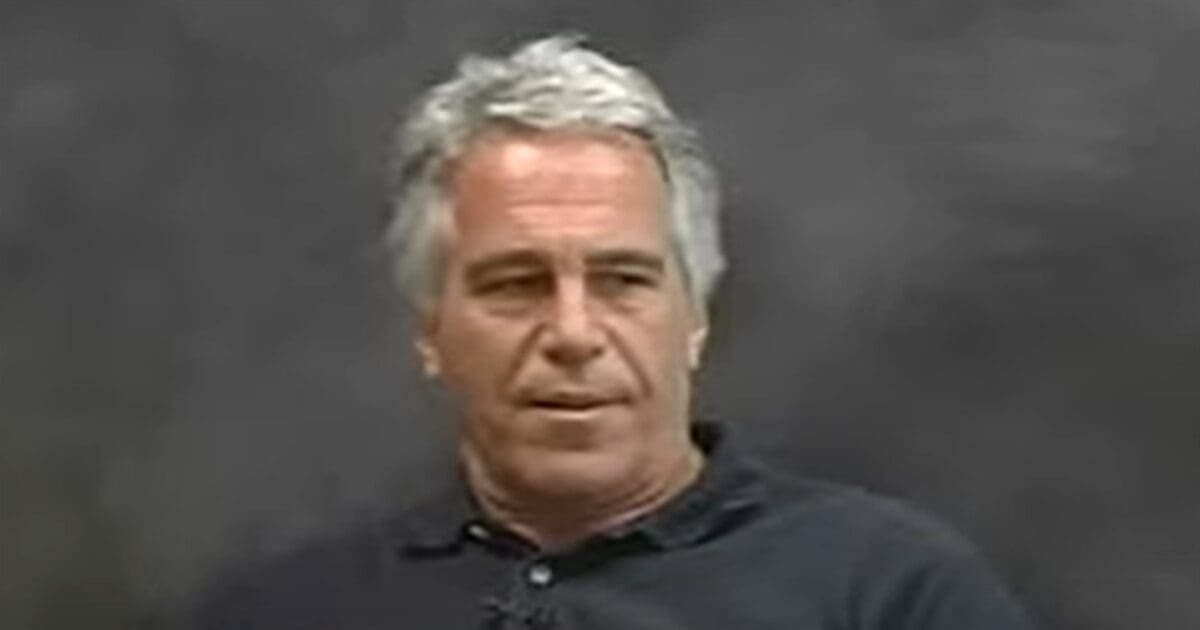

A new report from The New York Times claims that JPMorgan higher-ups turned a blind eye to internal warnings regarding Jeffrey Epstein.

One of the subjects that has captivated Americans over the last several years is the Epstein saga, namely, how he was able to get away with his various crimes and dealings without anyone appearing to bat an eye. A report from NYT looks into how red flags and internal warnings surrounding the billionaire financier were ignored, allowing him to get away with far more than the average person.

“Epstein had long been a treasured customer at JPMorgan. His accounts were brimming with more than $200 million,” the article explains. “He generated millions of dollars in revenue for the bank, landing him atop an internal list of major money makers. He helped JPMorgan orchestrate an important acquisition. He introduced executives to men who would become lucrative clients, like the Google co-founder Sergey Brin, and to global leaders, like Prime Minister Benjamin Netanyahu of Israel. He helped executives troubleshoot crises and strategize about global opportunities.”

“But a growing group of employees worried that JPMorgan’s association with a man who had pleaded guilty to a sex crime — and was under federal investigation for human trafficking — could harm the bank’s reputation. Just as troubling, anti-money-laundering specialists within the bank noticed Epstein’s pattern of withdrawing tens of thousands of dollars in cash virtually every month. These were red flags for illicit activity,” the piece continued.

Insiders within the company pressed, over and over again during the course of Epstein’s tenure as a client, to expel the man who would go on to become a registered sex offender. Despite the internal alarms, JPMorgan kept him around. Not only this, but the person expected to succeed CEO Jamie Dimon, Jes Staley, started a personal friendship with Epstein and defended the man to his own colleagues.

“This is not an honorable person in any way. He should not be a client,” said general counsel Stephen Cutler following a 2011 meeting with Epstein. Head of compliance William Langford agreed, but they were eventually overruled.

JPMorgan spokesman Joseph Evangelisti admitted that keeping Epstein on as a client “was a mistake and in hindsight we regret it, but we did not help him commit his heinous crimes.”

“We would never have continued to do business with him if we believed he was engaged in an ongoing sex trafficking operation,” the spox added.

DONATE TO BIZPAC REVIEW

Please help us! If you are fed up with letting radical big tech execs, phony fact-checkers, tyrannical liberals and a lying mainstream media have unprecedented power over your news please consider making a donation to BPR to help us fight them. Now is the time. Truth has never been more critical!

Success! Thank you for donating. Please share BPR content to help combat the lies.

We have no tolerance for comments containing violence, racism, profanity, vulgarity, doxing, or discourteous behavior. Thank you for partnering with us to maintain fruitful conversation.

![ICE Arrests Illegal Alien Influencer During Her Livestream in Los Angeles: ‘You Bet We Did’ [WATCH]](https://www.right2024.com/wp-content/uploads/2025/08/ICE-Arrests-Illegal-Alien-Influencer-During-Her-Livestream-in-Los-350x250.jpg)

![Gavin Newsom Threatens to 'Punch These Sons of B*thces in the Mouth' [WATCH]](https://www.right2024.com/wp-content/uploads/2025/08/Gavin-Newsom-Threatens-to-Punch-These-Sons-of-Bthces-in-350x250.jpg)

![Black BET Billionaire Donor Stuns Democrats, Gives $500K to Winsome Earle-Sears [WATCH]](https://www.right2024.com/wp-content/uploads/2025/08/Black-BET-Billionaire-Donor-Stuns-Democrats-Gives-500K-to-Winsome-350x250.jpg)