Lord Ashcroft KCMG PC is an international businessman, philanthropist, author and pollster.

Today the UK will typically lose £181 million through wealth migration. Incredibly, £181 million is the average daily capital exodus that is happening in front of our eyes. That is a staggering £7.5 million per hour, 24/7. The forecast loss for 2025 is £66 billion.

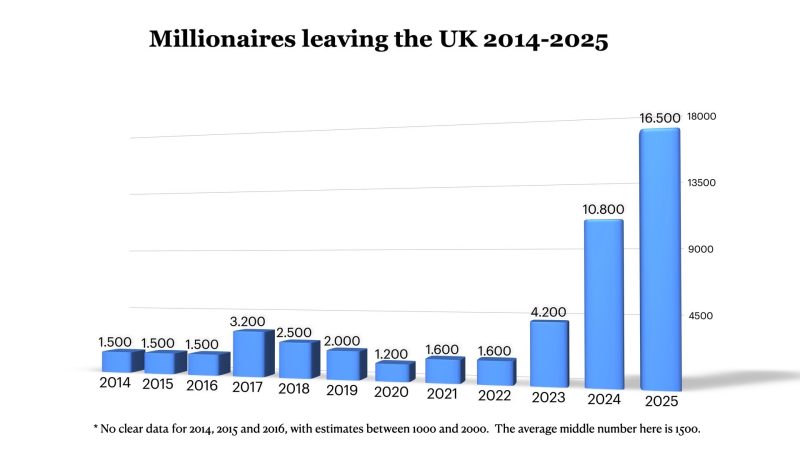

The pace of wealth migration in the UK is accelerating. In 2024, a record 10,800 affluent residents, each with liquid assets of at least £1 million, left the UK. This year the projected loss of millionaires is 16,500, a 53 percent increase. Back in 2022, some 1,600 millionaires left the UK. In just three short years – to 2025 – we are seeing a ten-fold increase in the numbers leaving the UK.

The tax revenue loss from this exodus in 2024 was £4.25 billion, equivalent to 528,000 average taxpayers. To put it in context, it is the equivalent of one major UK city being fiscally “nuked” in terms of its revenue for the public finances.

Does anyone in this Labour Government, which blunders from crisis to crisis, worry about these numbers? Do they have any plan on how to make up these massive losses caused by their policies?

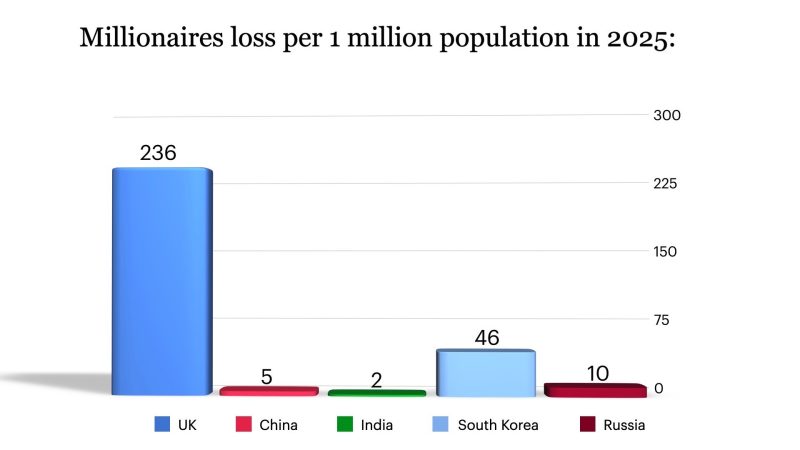

According to recent analysis from foreign investment experts Henley & Partners, the exodus of millionaires from the UK in 2024 was bigger than the total from the following countries combined: India, South Korea, Russia, South Africa, Brazil, Taiwan, Nigeria and Vietnam. These eight countries have a combined population of 2.3 billion, meaning that they have 33 times bigger population than the UK, yet we are losing more money and high-net-worth individuals.

In 2025, the UK again will have the highest loss of millionaires in the world, with 236 millionaires leaving the country per one million inhabitants. China will lose five, India two and Russia ten millionaires per one million of the population.

While the UK lost 10,800 millionaires in 2024, other countries – so-called “wealth hubs” – were attracting them: UAE 6,700, the US 3,800, Singapore 3,500 and Canada 3,200. Furthermore, Italy welcomed 2,200 millionaires, Greece 1,200 and Portugal 800. These nations are deemed competitive; the UK is not.

In 2022, Norway increased the wealth tax by 1.1 per cent, expecting US $146million in additional revenue. In fact, individuals with a net worth of US $54 billion left the country, leading to US $594 million less revenue. It is the law of unintended consequences, but the figures are there for all to see and to learn from.

Britain is bleeding money, people and talent at a staggering rate on a daily basis. This year there has been a 183 percent rise in British citizens applying for foreign citizenship or overseas residency.

The word is spreading that the UK is “un-investable” and it is becoming “fashionable” to leave UK, particularly London. It is a dangerous departure and such contagion will harm our economy and the British people, including the middle classes and the poor, for decades to come.

Once the people leave, they will settle in their new countries and new cities, buying property, building business and creating new jobs. Their children and grandchildren will, in turn, start in new schools and many will eventually become wealth creators too. The more time Britons spend in their new destinations, the less likely it is that they will return to live permanently in the UK.

For a time, the UK’s major asset was the English language, but now English is globally available, with English language universities and courses on all six continents. Such people can work and operate in English wherever they go, with tech and AI making distances less relevant.

The world is truly globalised and the word is spreading fast. High taxes and bureaucratic burdens are harming any country that implements such negative policies. In contrast, everyone hears about the countries that are welcoming, that are competitive and that are serious about their own future.

Once the rich leave one nation, the talented and the well-educated often follow because there are fewer well-paid jobs without successful companies. Furthermore, it’s not just the “rich” that are leaving. They are increasingly joined by the doctors, IT and AI specialists, engineers, professors, lawyers, wealth managers, pilots and many others.

Once the talented high-earners leave, there are major consequences for the middle class and lower-paid. Indeed, once the economy begins to fail, the less well-off and the poor becomes the biggest victims.

Forget the rhetoric and the soundbites from the Labour Government because the reality is clear.

Look to history and the facts that show socialist and communist demagoguery raises expectations, but it constantly fails to deliver on the shiny promises. Such policies wreck the countries where they are implemented, leaving these societies and its people to deal with the consequences.

As the rich depart and the tax base shrinks, our Labour Government will have to tax those who remain more heavily, as there will be less and less people to pay for these bad policies and poor services. We will see a vicious cycle that harms the UK and its people. There will be less money for schools, hospitals and the like, less funding for infrastructure, transport and maintenance.

The Labour Government seems unbothered that the UK is losing its biggest taxpayers. Yet, if this was a private company losing its largest customers, alarms bells would be sounding loud and clear.

Moreover, our Government is exacerbating the problem by trying to fight fire with oil not water, with its anti “non-dom” measures and ever-increasing taxes. The reality is that our “non-doms” each typically contribute between £120,000 and £180,000 annually in UK taxes.

The new left ideologues are desperately out of touch with the times we live in and the stakes are high. The big, wide world is full of opportunities, with dozens and dozens of countries competing to attract the high-value individuals. The UK’s wealthy and the talented are voting with their feet and nothing is being done to try to lure them back or to stop them from going in the first place.

The Government needs to address these major issues as a matter of urgency. We have already seen public tears from Rachel Reeves over the financial knock-on of Labour’s U-turn over its planned welfare reforms. There could be plenty more tears from the Chancellor if and when she finally grasps the enormity of the consequences from the UK’s capital exodus.