“As Grover Norquist points out, “No Republican in the House or Senate has voted for a tax rate increase in 35 years,” tweets former Speaker of the House Newt Gingrich (R). “Not since October 1990. “People suggesting an income tax rate increase should be reminded of this 35 year reality.”

As Grover Norquist points out “No Republican in the House or Senate has voted for a tax rate increase in 35 years.

Not since October 1990. “ people suggesting an income tax rate increase

Should be reminded of this 35 year reality.— Newt Gingrich (@newtgingrich) April 13, 2025

Tax rate increases limit the amount of money flowing throughout the U.S. economy. A tax rate increase is an upward adjustment in percentage terms of a tax paid by a taxpayer.

There are various types of taxes. Income taxes are taxes on the gross amount of income someone earns through wages, the source of which is in many cases an employer; and the higher the income tax rate, the less money available for an employee to take home from work. Corporate taxes are taxes paid by businesses on revenue income, and the higher the corporate tax rate, the less profit left over for a business to use. Consumption taxes are taxes paid at the point of sale by a consumer, and the higher a consumption tax rate, the more expensive the item or service being purchased.

A small tick upward can have a huge effect. Moving from a 10 to 15 percent income tax rate can be consequential for an employee because five fewer dollars available to be taken home out of $100 of income will result in some form of budgetary sacrifice. A 30 to 35 percent corporate tax increase can mean jobs get cut, salaries get reduced, product quality decreases, product quantity decreases, and so on. A 10 to 15 percent consumption tax rate jump can be the difference between some consumers being able or not to afford certain products and services.

Higher taxes can squeeze the economy out of the free flow of capital. When employees take less home from their employer, they have less to spend, invest, and save. Thus, less gets spent and invested into the economy. When businesses pay more of their revenue in taxes, there is less of it to pay employees, to purchase overhead, and to reinvest. Again, less gets put back into the economy. When a consumer cannot afford an item or service due to a higher consumption tax, no transaction or exchange takes place. Same answer, it means fewer dollars flow throughout the overall economy.

Socialists and redistributionists seem fond of taxation as a means of government taking from some and putting what is taken in the hands of others. And while that is an abuse and a perversion of the tax system, some tax dollars and government revenue are needed and useful. We hear all the time about the need to rebuild the military, and tax dollars go to that. We hear about the need to maintain the solvency of entitlement programs such as Social Security and Medicare, and tax dollars go to those. It pays for some of the important functions of our government. Tax revenue can go toward local fire, police and other public works that serve a community’s public good.

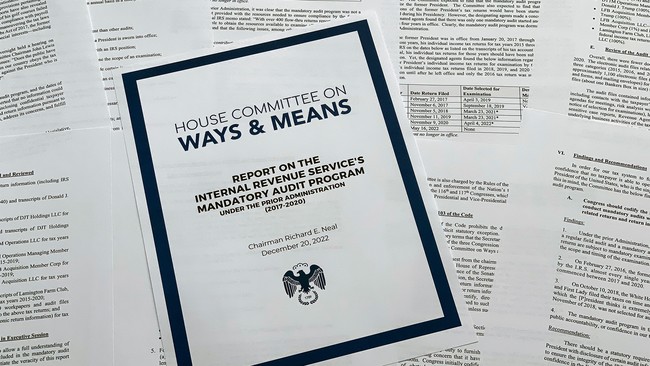

Perhaps more taxes should be flat. Perhaps the tax code should be able to fit on an index card. Perhaps the IRS is not the right vehicle to collect taxes and enforce tax laws. There are debates that can ring out and solutions that can be offered to improve the way it works here. Bottom line, ours should not be a nation and we should not be a people overburdened by taxation.

![NYC Tourist Helicopter Falls into Hudson River, Siemens Executive and Family Among Those Killed [WATCH]](https://www.right2024.com/wp-content/uploads/2025/04/NYC-Tourist-Helicopter-Falls-into-Hudson-River-Siemens-Executive-and-350x250.jpg)

![Green Day’s Cringe Trump Diss Ends in Fire and Evacuation [WATCH]](https://www.right2024.com/wp-content/uploads/2025/04/Green-Days-Cringe-Trump-Diss-Ends-in-Fire-and-Evacuation-350x250.jpg)

![Red Sox Fan Makes the ‘Catch of the Day’ with Unconventional ‘Glove’ [WATCH]](https://www.right2024.com/wp-content/uploads/2025/04/Red-Sox-Fan-Makes-the-‘Catch-of-the-Day-with-350x250.jpg)

![Bikini Clad Spring Breakers Prove Our Education System is Failing Students [WATCH]](https://www.right2024.com/wp-content/uploads/2025/03/Bikini-Clad-Spring-Breakers-Prove-Our-Education-System-is-Failing-350x250.jpg)