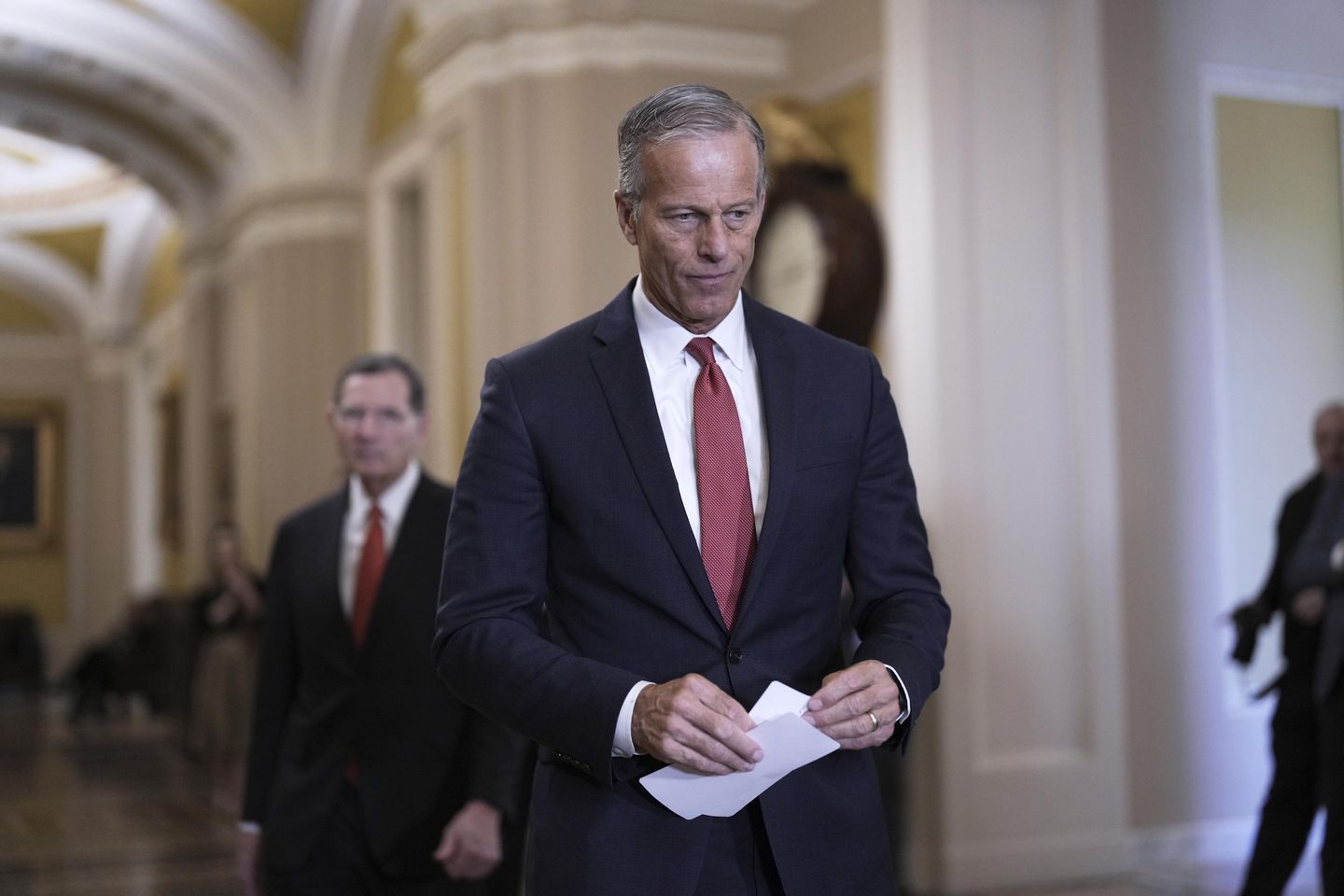

Senate Majority Leader John Thune is not committing to a specific deadline for passing President Trump’s legislative agenda package, even as other Republicans eye summer holidays as targets.

House Speaker Mike Johnson, Louisiana Republican, has set a goal of passing the budget reconciliation package through the House by Memorial Day. And Treasury Secretary Scott Bessent has said Republicans hope to complete the bill by July 4.

Several Republican senators view July 4 as their deadline for passing the package, but Mr. Thune declined to adopt that as a hard deadline.

“I’m always reluctant to commit to deadlines, because you might miss them,” the South Dakota Republican said Tuesday. “Obviously there are aspirational deadlines.”

The House and Senate took two months to adopt a unified budget blueprint needed to unlock the filibuster-proof reconciliation process, but never fully got on the same page. The budget includes different tax and spending targets for House and Senate committees, although Mr. Johnson and Mr. Thune agreed to a shared goal of cutting at least $1.5 trillion in spending.

For months, Mr. Johnson had said he wanted to have the reconciliation package on Mr. Trump’s desk by Memorial Day. But he has recently started to walk that back and is only committing the House to adhering to that deadline.

“We are on track to pass the bill out of the House, as we’ve said from the very beginning, get it over to the next stage by Memorial Day,” Mr. Johnson said Tuesday. “Now, I don’t know how long the Senate’s going to take to do their piece, but I was very encouraged after the meeting yesterday.”

Mr. Johnson was referring to a meeting of what is known as “the big six,” which includes him, Mr. Thune, Mr. Bessent, White House economic director Kevin Hassett, House Ways and Means Chairman Jason Smith and Senate Finance Chairman Michael Crapo.

The big six have been meeting regularly for weeks to discuss the tax portion of the package, which will permanently codify Mr. Trump’s first-term tax cuts, which are set to expire this year, and expand upon them with new proposals like tax exemptions for tips and overtime income.

“The tax bill is going much better than I would have thought when I took office on Jan. 28, and that’s through President Trump’s leadership,” Mr. Bessent told reporters Tuesday at the White House press briefing.

Mr. Johnson is planning on the Ways and Means Committee marking up the tax portion of the package next week, although Mr. Smith has declined to publicly commit to a date for his panel to finish.

One issue that still needs to be resolved is how to deal with the federal deduction for state and local taxes, known as SALT. The 2017 tax law capped the SALT deduction at $10,000 for individuals and joint filers.

Republicans from high-tax blue states like New York, New Jersey and California have said they will not vote for a bill that doesn’t provide adequate relief from the SALT cap for their constituents.

They’re set to meet with GOP leaders on Wednesday to discuss a potential compromise.

Seven House committees are marking up their portions of the bill this week, which started with the Armed Services, Homeland Security and Education & Workforce panels on Tuesday.

Four committees will mark up their portions on Wednesday: Judiciary, Transportation and Infrastructure, Oversight and Government Reform and Financial Services.

And the remaining four committees involved in the process – Ways and Means, Agriculture, Natural Resources, and Energy and Commerce – will hold markups next week, according to Mr. Johnson and House Majority Leader Steve Scalise, Louisiana Republican.

But those committees are still negotiating details and have big issues to resolve.

For example, the Energy and Commerce panel has to decide how much savings to find from Medicaid as it works to achieve an $880 billion spending cut floor.

Likewise, the Agriculture panel is deciding how much to cut from the Supplemental Nutrition Assistance Program, formerly known as food stamps, as it pursues its $230 billion savings target.

Centrist Republicans have cautioned their leaders against cutting too far into either program and risk reducing benefits for the most vulnerable.

The House has taken the lead on the reconciliation process, but lawmakers are coordinating with their Senate counterparts to varying degrees.

The House Armed Services Committee actually released its portion of the bill, $150 billion in defense funding, in conjunction with the Senate Armed Services Committee.

Sen. Roger Wicker, Mississippi Republican and chairman of the Armed Services panel, said it is a joint product that represents “a lot of cooperation and consultation.”

“I think we’ve got a sound deal, and I hope that deal sticks,” he said.

Mr. Crapo and Mr. Smith have been working together in the big six meetings and elsewhere on the tax portion, but it’s not clear yet whether they will end up with identical committee products.

“We’re coordinating as closely as we can,” Mr. Crapo said. “Will it end up exactly the same? I hope so, but I can’t predict that.”

He said he’s not yet decided whether he would do a separate markup in the Senate Finance Committee.

Sen. Shelley Moore Capito, the West Virginia Republican who chairs the Environment and Public Works Committee, said she has coordinated some with the House but is planning on releasing and marking up her own bill, hopefully sometime in May.

“Ours won’t be as quick as theirs,” she said.

Alex Miller contributed to this report.

![Stephen Miller Announces New Goal for ICE Mass Deportation Effort [WATCH]](https://www.right2024.com/wp-content/uploads/2025/05/Stephen-Miller-Announces-New-Goal-for-ICE-Mass-Deportation-Effort-350x250.jpg)

![Simone Biles Defends Trans Pitcher and Mocks Riley Gaines, It Doesn’t Go Well [WATCH]](https://www.right2024.com/wp-content/uploads/2025/06/Simone-Biles-Defends-Trans-Pitcher-and-Mocks-Riley-Gaines-It-350x250.jpg)

![LAPD Praises 'Peaceful' Rioters as They Set Cars on Fire and Attack Feds [WATCH]](https://www.right2024.com/wp-content/uploads/2025/06/LAPD-Praises-Peaceful-Rioters-as-They-Set-Cars-on-Fire-350x250.jpg)

![Fans Shocked as Katy Perry Stops Concert After She’s Ambushed by Deranged Fan Onstage [WATCH]](https://www.right2024.com/wp-content/uploads/2025/06/Fans-Shocked-as-Katy-Perry-Stops-Concert-After-Shes-Ambushed-350x250.jpg)

![LA Protest Casualty? Dead Body Found as Riots Stretch Into Fifth Night [WATCH]](https://www.right2024.com/wp-content/uploads/2025/06/1749642627_LA-Protest-Casualty-Dead-Body-Found-as-Riots-Stretch-Into-350x250.jpg)