Inflation has come down from its post-pandemic peak, but that is small consolation for families still paying far more for groceries, rent, insurance, and utilities than they were just a few years ago. Under President Donald Trump, prices are no longer rising at the breakneck pace seen during the Biden years, yet the damage done by that inflation remains very real for working- and middle-class households. Poll after poll shows the same result: even as headline economic indicators improve, affordability remains voters’ top concern.

That disconnect between better macroeconomic data and persistent household strain among the working class is the backdrop for President Trump’s proposal to send Americans $2,000 checks funded by tariff revenue—a so-called “tariff dividend.”

By most conventional measures, the U.S. economy is in better shape than many expected. Inflation, which peaked near 9 percent in 2022, has fallen sharply and is now closer to the Federal Reserve’s 2 percent target than at any point in recent years.

That is genuine progress, even if it does nothing to reverse the cumulative price increases Americans have already absorbed. (RELATED: Is Trump Blaming The Wrong Culprit For Unaffordable Houses?)

Wages have also improved. Nominal wage growth has been solid, and in many sectors—particularly goods-producing industries and lower-wage service jobs—pay has recently begun to outpace inflation. After years in which rising prices steadily eroded purchasing power, real wages are finally moving in the right direction again.

But the recovery has been uneven, and for many families it has not been enough to restore their pre-inflation standard of living.

Economic growth has likewise surprised to the upside. GDP has posted stretches of annualized growth above 3 percent, business investment has held up better than expected, and consumer spending has remained resilient despite higher interest rates.

By traditional metrics, this is an economy regaining its footing, all due to President Trump’s economic stewardship.

Yet these economic gains coexist with stubborn affordability problems. Housing costs remain historically high relative to incomes.

Healthcare and insurance premiums continue to rise faster than overall inflation.

Essential services consume a larger share of household budgets than they did before the pandemic. According to 2024 data from the Federal Reserve, roughly 40 percent of Americans could not cover a $400 emergency expense without borrowing or selling assets.

For those households, improved economic statistics feel abstract when monthly bills still don’t add up. (RELATED: EXCLUSIVE: GOP Rep Introduces Bill To Prioritize American Homeownership Over Wall Street Leeches)

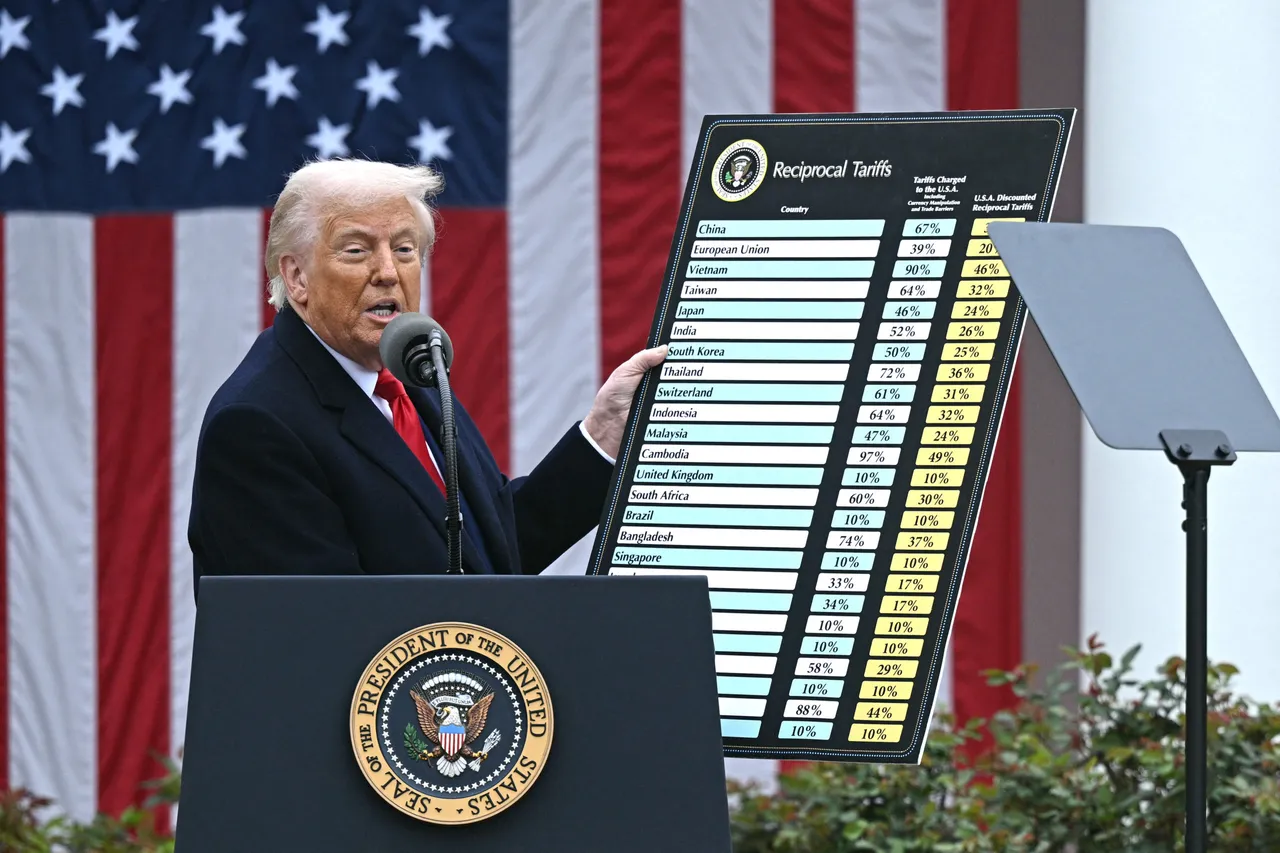

That is why the President Trump’s tariff dividend proposal deserves serious consideration. Administration estimates put federal tariff collections at more than $600 billion.

TOPSHOT – US President Donald Trump holds a chart as he delivers remarks on reciprocal tariffs during an event in the Rose Garden entitled “Make America Wealthy Again” at the White House in Washington, DC, on April 2, 2025. (Photo by Brendan SMIALOWSKI / AFP) (Photo by BRENDAN SMIALOWSKI/AFP via Getty Images)

Tariffs, whatever one thinks of them as trade policy, are taxes. Like any other tax revenue, those funds flow into the Treasury and are allocated by Congress. The proposal would simply return a portion of that money to American households through a one-time payment.

The strongest case for the tariff dividend is fiscal, not political. Unlike the pandemic stimulus checks, which were financed by massive deficits and accompanied by unprecedented monetary expansion, a tariff-funded payment would rely on revenue already collected. It would not require new borrowing or permanently expand federal spending.

Any such payment would, of course, require congressional approval, most likely through budget reconciliation. That is not a technicality. It reflects the Constitution’s clear assignment of taxing and spending authority to Congress, and it would ensure that responsibility for the policy rests where it belongs.

Legal uncertainty around tariffs only heightens the importance of legislative action. The Supreme Court may soon rule on the scope of the executive branch’s authority to impose tariffs unilaterally. If the Court limits that authority while leaving existing tariffs in place, Congress’ role in directing tariff revenue will become even more central.

A flat, one-time $2,000 payment to middle-income Americans also has practical advantages. It can be implemented quickly, avoids the complexity and distortions of means-tested programs, and does not create a permanent entitlement. For lawmakers wary of locking in long-term spending commitments, those features matter. (RELATED: Can Republicans Crack The Affordability Problem In 2026? Here’s What They’re Planning)

None of this is a substitute for deeper economic reform. Expanding housing supply, restraining healthcare costs, boosting productivity, and restoring a simpler, flatter tax code remain essential to long-term prosperity. But those fixes take time. A tariff dividend addresses a narrower problem: the immediate affordability pressures facing families even as broader economic indicators improve.

The larger question raised by the proposal is one of policy coherence. If tariffs are going to remain a significant feature of U.S. trade policy, Congress must decide how their costs and benefits are shared. Returning a portion of tariff revenue to American households is a straightforward way to make sure those benefits are felt where they matter most—at the kitchen table.

Cesar Conda, a former Chief of Staff to former Senator Marco Rubio (R-FL) and a former Assistant for Domestic Policy to the Vice President, is a member of the economic policy council of the Committee to Unleash Prosperity.

The views and opinions expressed in this commentary are those of the author and do not reflect the official position of the Daily Caller.