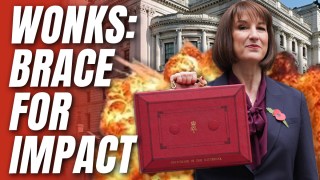

Wonks Warn of Huge Tax Hikes After Reeves Spending Review

Reactions from Westminster’s wonks on the spending review are in, and the message is clear: huge tax hikes are coming in the Autumn Budget. Reeves confirmed that public spending will end up at 44.6% of GDP in 2028/29 – the biggest spending spree since World War Two. Labour is preparing to come back for more to pay for it…

- The Institute of Economic Affairs warned to “brace for tax rises”, with executive director Tom Clougherty saying: “To spend less, government must do less – and employ fewer people. It isn’t clear that message has got through. Crucially, this Spending Review did nothing to address the supposed ‘fiscal black hole’ that exists against the Chancellor’s fiscal rules. So we should brace ourselves for tax increases in the Autumn, and a Summer of speculation over exactly where they will fall.” Reeves has been laying the groundwork for those…

- The Adam Smith Institute’s Maxwell Marlow warned of the same: “Without cuts to red tape, the economic growth required to generate the necessary tax revenue simply will not materialise. The cost of government is already nearing record levels and is set to rise further. If these spending commitments are to be sustained without shifting the burden onto future generations, tax rises may become inevitable.”

- The Taxpayers’ Alliance’s CEO John O’Connell also hit out at the bloated public sector: “We now know there is going to continue to be harsh austerity for taxpayers as they stare down the barrel of yet more devastating tax hikes in the Autumn, all to fund a profligate, wasteful and bloated public sector. Politicians have to be on the side of taxpayers and businesses, which unfortunately very clearly isn’t the case.” He also points out that national debt is heading towards 100%…

- Left-wing think tank/Labour press arm the Institute for Public Policy Research’s executive director Harry Quilter-Pinner unsurprisingly called for more spending to be funded by tax hikes: “Even after the Budget, which raised taxes and increased borrowing, the government still had to make tough choices today. There are much needed big increases in investment in infrastructure, especially transport and housing, which will make a huge difference to the economy – helping to drive growth and living standards. It will have to look again at taxes over the coming years.”

- The Centre for Policy Studies warn of Reeves putting the UK on “risky economic path: one of high taxes, high spending, high borrowing and low growth”. Director Robert Colvile said: “Sadly, the Chancellor today kept us on the same precarious path, with billions poured into an unreformed NHS at the expense of other public services and day-to-day and capital spending alarmingly frontloaded. As a result of Labour’s choices in government, more tax increases are inevitable – not just in the Autumn Budget but for years to come.”

-

The Jobs Foundation’s CEO Georgiana Bristol highlights the lack of action to alleviate the jobs crisis: “With 109,000 job losses announced in just the last month, there is the need for drastic action to make sure that we don’t enter a period of stagflation. The measures announced today must be paired with a raft of pro-business policies in the Autumn Budget, starting with a reversal of the Employer NICs increase and reform of the Employment Rights Bill.” Rayner’s union bill will further stifle any growth…

- The Growth Commission’s Ewen Stewart slammed Reeves for showing a how little she “understands how sustainable growth is achieved. The spending review focused on centralised spending rather than seeking to grow the cake. There was nothing to encourage private endeavour and no rolling back of regulation.”

-

The Centre for Social Justice’s Joe Shalam blasted the government for “acting on borrowed time and money” warning that without radical action, Reeves “will not reunite our deeply divided nation” or prevent “the next big political earthquake.”

-

Policy Exchange’s senior research fellow Ben Ramanauskas attacked the defence uplift and criminal justice budgets not “going far enough”, warning that the spending announcements today “will almost certainly have to place even greater strain on the public finances by increasing borrowing or adding extra burdens to households and businesses by raising taxes.”

Brace for Autumn…

![Former Bravo Star Charged After Violent Assault Using a Rock-Filled Sock in Tennessee Walmart [WATCH]](https://www.right2024.com/wp-content/uploads/2025/07/Former-Bravo-Star-Charged-After-Violent-Assault-Using-a-Rock-Filled-350x250.jpg)

![NYC Man Snatches Child Off The Sidewalk, Parents Chase Him Down [WATCH]](https://www.right2024.com/wp-content/uploads/2025/07/NYC-Man-Snatches-Child-Off-The-Sidewalk-Parents-Chase-Him-350x250.jpg)

![Karoline Leavitt Levels CNN's Kaitlan Collins and Other Legacy Media Reporters [WATCH]](https://www.right2024.com/wp-content/uploads/2025/07/Karoline-Leavitt-Levels-CNNs-Kaitlan-Collins-and-Other-Legacy-Media-350x250.jpg)

![Man Arrested After Screaming at Senators During Big Beautiful Bill Debate [WATCH]](https://www.right2024.com/wp-content/uploads/2025/06/Man-Arrested-After-Screaming-at-Senators-During-Big-Beautiful-Bill-350x250.jpg)